How to Choose the Best Accounting Service for Your Small Business

Every small business owner in Atlanta, Georgia, knows that precise financial management is crucial for long-term success. Choosing the best accounting service for small business can make the difference between growth and financial setbacks. From ensuring IRS compliance to unlocking tax savings, a trusted accounting partner helps local businesses thrive with confidence in their numbers.

Essential Services Offered by the Best Accounting Service for Small Business

The best accounting service for small business goes beyond basic bookkeeping. Leading CPA firms offer a comprehensive suite of services tailored for Atlanta-based companies, including:

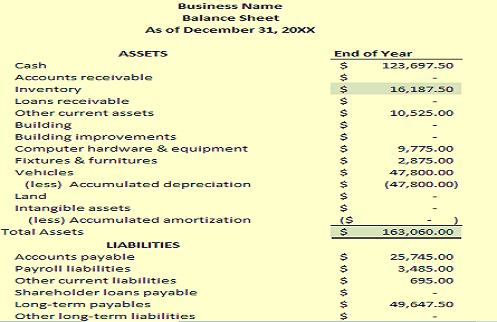

- Bookkeeping: Accurate recordkeeping ensures error-free financial statements, simplifying tax season and loan applications.

- Tax Planning and Filing: Proactive planning and expert preparation help small businesses take advantage of tax-saving opportunities and meet state and federal obligations efficiently.

- Financial Reporting: Timely profit and loss statements, like the one shown above, offer insights to guide business strategy and attract investors.

- Tax Resolution: If a tax issue arises, a qualified CPA can negotiate with the IRS and state agencies on your behalf, reducing stress and financial risk.

Moreover, studies show that U.S. small businesses lose thousands annually due to common accounting errors and missed deductions. According to the 2023 Accounting Today survey, over 65% of small business owners feel more confident about their finances after hiring professional accountants. In addition, the Small Business Administration highlights that services like expense tracking and payroll processing are essential for compliance and growth, especially in dynamic markets like Atlanta.

Why Atlanta Entrepreneurs Choose the Best Accounting Service for Small Business

Finding the best accounting service for small business in Atlanta means selecting a CPA firm that understands local regulations and the unique challenges for Georgia-based companies. Look for professionals who:

- Use the latest cloud accounting tools for 24/7 access to your financial data.

- Offer personalized tax strategies that reflect Georgia-specific credits and incentives.

- Are proactive in identifying ways to minimize tax burdens and improve profitability.

- Provide consultative support, helping you scale as your business evolves.

Therefore, partnering with a skilled CPA ensures robust compliance, peace of mind, and real advantages in a competitive Atlanta business scene.

How to Evaluate the Best Accounting Service for Small Business Providers

To select the best accounting service for small business, always consider:

- Professional credentials—ensure your provider is state-licensed and experienced with small businesses.

- Local expertise—choose firms familiar with Atlanta’s tax codes and regulations.

- Transparent pricing—avoid hidden fees by confirming the full range of services included.

In addition, check for client testimonials and industry memberships to assess reliability.

In conclusion, hiring the best accounting service for small business is an investment that pays dividends through optimized taxes, accurate reporting, and sound financial growth. If you operate in Atlanta, choose a CPA who knows your industry and local laws. Contact Sanz Virtual Enterprise, LLC or visit https://www.sve-accountingandtaxes.com/special-offers-and-promotions-cpa-small-business-accounting/ today to schedule a CPA consultation and experience the support your Georgia business deserves.