Mastering Your Finances: Essential Small Business Accounting and Bookkeeping Services

Managing finances effectively can be the difference between success and struggle for any business. For Atlanta entrepreneurs, investing in small business accounting and bookkeeping services ensures you remain compliant and aware of your company’s financial health. As a local CPA firm, we understand how these services empower Atlanta, Georgia, businesses to grow and prosper.

Why Small Business Accounting and Bookkeeping Services Matter in Atlanta

Atlanta is home to a thriving community of small businesses driving Georgia’s economy forward. However, without proper accounting and bookkeeping, owners risk errors, missed deductions, and compliance issues. According to the U.S. Small Business Administration, accurate record-keeping is key to maximizing tax savings and ensuring smooth business operations.

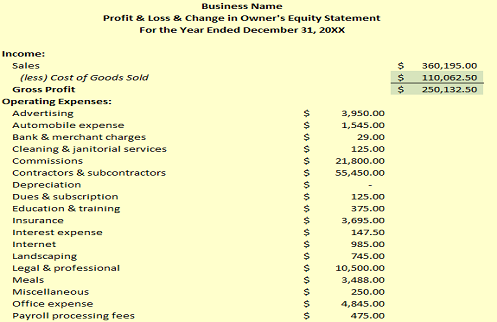

- Bookkeeping: Track day-to-day transactions, monitor cash flow, and reconcile accounts regularly.

- Tax Planning and Preparation: Strategic tax planning helps uncover deductions and credits that minimize your liability.

- Financial Reporting: Reliable financial statements let you make confident decisions and demonstrate your business’s strength to stakeholders.

- Tax Resolution: Specialists help resolve IRS notices, audits, or accumulated back taxes.

A 2023 Accounting Today report noted a 28% increase in IRS audits for small businesses over the last year—making professional guidance more critical than ever. In addition, Atlanta-based CPAs possess the experience and local regulatory knowledge to navigate Georgia’s unique tax landscape.

The Impact of Customized Small Business Accounting and Bookkeeping Services

With personalized small business accounting and bookkeeping services, your Atlanta business can stay IRS-compliant, improve profitability, and reduce risk. We create custom plans tailored to your industry, whether you’re in retail, real estate, or the service sector. Timely financial insight means you can respond faster to market changes and control expenses before they escalate.

- Gain confidence during tax season with organized, audit-ready books.

- Analyze month-to-month trends for smarter expansion decisions.

- Unlock local tax incentives and credits unique to Georgia businesses.

Furthermore, when you outsource accounting and bookkeeping, you free up time to focus on core operations and customer service—fueling business growth in Atlanta’s competitive environment.

How to Choose the Right CPA in Atlanta

Selecting the ideal partner for your business finances is essential. Look for a firm with certified public accountants, local Atlanta expertise, and a reputation for responsive communication.

- Evaluate the firm’s range of services, including tax resolution and financial consulting.

- Ensure transparent pricing and customized plans for small businesses.

- Ask for client references, particularly from similar industries within Georgia.

By leveraging professional support, Atlanta small businesses can simplify complex tasks while staying ahead of tax and regulatory changes.

In conclusion, investing in small business accounting and bookkeeping services offers Atlanta business owners peace of mind and the foundation for sustainable success. To discover how Sanz Virtual Enterprise, LLC can help your business thrive, contact us or visit www.sve-accountingandtaxes.com/special-offers-and-promotions-cpa-small-business-accounting/ today for a consultation with a skilled Atlanta CPA.