Streamline Your Finances: How to File My Business Taxes Online Efficiently

For small business owners in Atlanta, Georgia, managing taxes can quickly become overwhelming. With evolving tax regulations and deadline pressure, the need to file my business taxes online efficiently is more critical than ever. Embracing online tax filing not only streamlines compliance but also improves accuracy, saves valuable time, and keeps your business ahead in a competitive market.

Comprehensive Atlanta CPA Services for Online Tax Filing

Professional CPA firms in Atlanta offer a range of services geared toward simplifying your tax experience. Bookkeeping services ensure your financial data stays organized year-round. With digital bookkeeping platforms, integrating real-time expense and revenue tracking into tax software becomes seamless, helping you file my business taxes online without stress.

- Tax Planning: Strategic tax planning throughout the year helps maximize deductions and minimize liabilities. Atlanta businesses can leverage specialized local knowledge to ensure both compliance and savings.

- Tax Resolution: If you encounter IRS notices or tax discrepancies, accountants provide guidance to resolve these efficiently. Professional representation is especially valuable when filing taxes online, as digital records can be quickly accessed and organized for audits.

- Tax Preparation & Savings: Modern CPAs utilize secure, cloud-based tax software. This approach not only accelerates preparation, but also uncovers new tax savings opportunities tailored for Georgia businesses. According to the IRS, e-filing speeds refunds and reduces errors.

Moreover, with e-filing adoption rates exceeding 90% (Statista, 2023), it’s clear that Atlanta’s small businesses gain a competitive edge by choosing to file their business taxes using a virtual process and platform.

Why File My Business Taxes Online with a CPA in Atlanta?

When you file your taxes online with a local Atlanta CPA, you benefit from expert oversight tailored to state and city tax codes. In addition, many CPA firms now offer fully virtual consultations and document sharing. This allows you to securely upload your tax documents, sign electronically, and receive instant updates. The process is transparent and ensures you meet all Georgia filing deadlines without last-minute stress.

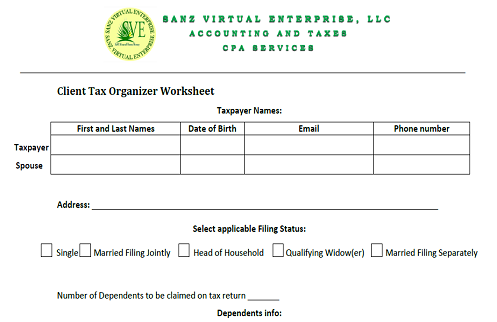

For example, Sanz Virtual Enterprise, LLC guides Atlanta entrepreneurs through every step, from initial bookkeeping to final submission, ensuring accurate filings and maximum compliance. Our virtual approach saves both time and money throughout tax season.

Essential Steps to File My Business Taxes Online Efficiently

- Gather all financial documents, including income statements, receipts, and prior returns, in digital format.

- Choose a secure, reputable online tax filing solution—preferably in consultation with a trusted Atlanta CPA.

- Collaborate with your accountant to review and maximize eligible deductions and credits.

- Submit your tax return electronically and retain digital copies for your records.

Following these steps helps Atlanta business owners with their tax filing obligations in an efficient and compliant manner.

Conclusion: Trust Atlanta CPAs to Help You File My Business Taxes Online

To summarize, choosing to file my business taxes online with the help of a professional Atlanta CPA simplifies compliance, uncovers tax savings, and delivers peace of mind. Let Sanz Virtual Enterprise, LLC help your local business thrive—contact us today for a free personalized tax consultation with a CPA who understands Georgia’s unique landscape.