Bookkeeping Help for Small Business: A Practical Guide to Staying Financially Fit

Every small business in Atlanta, Georgia, faces the challenge of staying on top of its finances. Bookkeeping help for small business is more than just a necessity—it’s the foundation for growth, compliance, and peace of mind. Whether you run a startup or a long-standing Atlanta enterprise, efficient bookkeeping can mean the difference between profitability and pitfalls.

What’s included in Small Business Bookkeeping?

Professional bookkeeping services go far beyond managing daily transactions. In addition to basic record-keeping, Atlanta CPA firms offer:

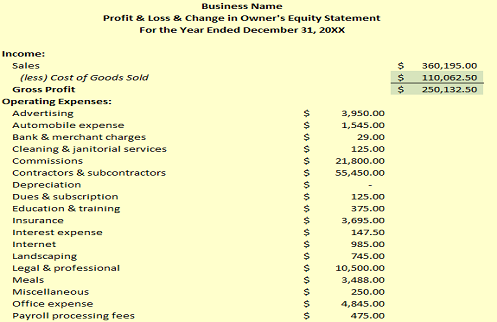

- Accurate financial reporting — Ensuring your profit and loss statements, like the one above, reflect your real business performance.

- Tax planning and tax savings strategies — Proactive guidance to minimize your tax liabilities throughout the year.

- Tax resolution assistance — Helping resolve IRS or Georgia Department of Revenue issues quickly and efficiently.

- Expense tracking and payroll processing — Streamlining payments to staff and vendors, as illustrated by detailed payroll and contractor entries on P&L statements.

According to the SCORE Association, inadequate bookkeeping costs U.S. businesses billions annually, highlighting why expert help is crucial. Therefore, relying on DIY solutions may expose your business to financial risks and lost opportunities.

Why Local Bookkeeping Help for Small Business in Atlanta Matters

Every city has unique tax codes and business regulations. That’s why bookkeeping help for small business is best when local. Atlanta CPAs understand Georgia’s tax deadlines, local deductions, and state-specific incentives. For example, a Georgia CPA will know how to allocate operating expenses—such as legal, professional, and payroll processing fees for local compliance. Moreover, having a local expert provides quick, in-person consultations and insights into financial patterns common among Atlanta’s business community.

According to the Intuit QuickBooks Resource Center, leveraging professional bookkeeping allows business owners to focus more on growth and less on paperwork. With local expertise, your Atlanta business gets guidance tailored to your market and regulatory environment.

Maximize Growth with Small Business Bookkeeping

With the right bookkeeping help for small business, you don’t just meet obligations—you gain insights to steer your business forward. For instance, consistently reviewing detailed profit and loss statements uncovers trends in expenses, such as rising legal or marketing costs, so you can make informed decisions. In addition, CPAs can recommend tax savings strategies and help you avoid penalties with timely and accurate reporting.

In summary, partnering with a skilled Atlanta CPA for bookkeeping help for small business transforms your financial management. You’ll gain confidence, reduce stress, and unlock new opportunities for growth. Reach out to Sanz Virtual Enterprise, LLC or visit https://www.sve-accountingandtaxes.com/special-offers-and-promotions-cpa-small-business-accounting/ for a consultation and stay financially fit—whether you’re in Midtown, Buckhead, or anywhere in Georgia.